The UK's fast-food market is under immense pressure, yet Meaningful Vision's latest analysis pinpoints pizza delivery brands as enduring the most intense competition across all QSR segments.

As the sector grapples with inflation, rising costs, and evolving consumer habits, pizza delivery stands out in its fierce battle for customers.

Despite being a delivery staple, pizza prices rose just 2% year-on-year (YoY) – far below the 6% average across QSR. This, says Maria Vanifatova, CEO of Meaningful Vision, is down to lower product differentiation, and a heavy reliance on meal deals and promotional pricing. “Unlike other fast food places, which vary by type of food offered in menu, pizzas across brands are more uniform, and that makes price the key battleground,” she explains.

Meal deals are now more frequent (up from 16% to 20% YoY), while the average price of a pizza meal deal has actually fallen 2%, bucking inflationary trends. The sector’s heavy reliance on delivery has also added to the pressure, as has the tension between partnering with and competing against third-party platforms such as Uber Eats, Just Eat, and Deliveroo.

Looking more broadly across the hospitality industry, other insights from January to April 2025 include:

Store growth: Overall outlet growth is up in 2025 (3.9%) compared to 2024 (2.1%), but fast-food expansion is slowing, down from 3.8% last year to just 1.0%. Segments like chicken, ethnic, and pizza are seeing especially steep slowdowns, with pizza the only segment in decline in 2025 (-0.8%).

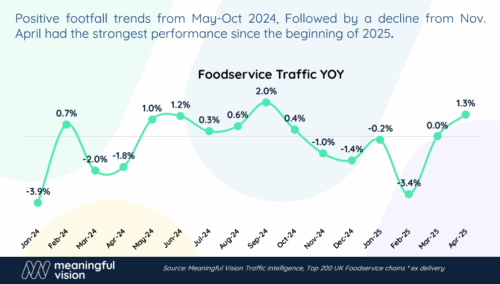

Overall footfall: Despite outlet growth, overall footfall is down slightly (-0.6%), indicating weaker footfall per site.

Time interval footfall: There has been a slowdown in breakfast footfall (-14.4%), while daytime is now the fastest growing. Midday (12–3pm) traffic is up by 3.0%, and late afternoon (3–6pm) by 8.1%.

Promotions: Use of promotions remains high across the board. Special price was a top tactic among price promotions in restaurants, up from 70% in 2024 to 72% in 2025. Conversely, Percentage Discount was top within delivery with 45%, while for chicken shops, gamified apps and tiered rewards are becoming the norm. For the Pizza delivery segment, 57% of pizza promotions on delivery platforms are percentage discounts that are significantly higher than the 43% average across fast food. Offers such as “Buy One, Get One Free” (15%) and special bundle pricing (17%) are also widely used, while customer loyalty programs remain underutilised.

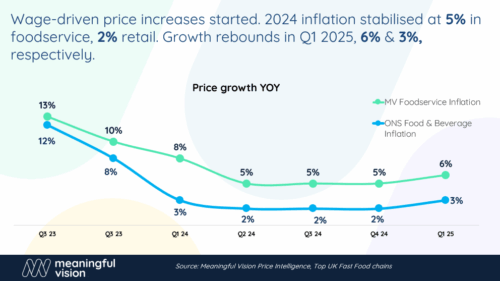

Prices: Pricing growth has been most pronounced in the foodservice industry (up 6.1%) compared to price growth on food and beverages in retail (up 3%), while pizza trails far behind with just 2% price growth, highlighting its unique price compression challenge.

Putting the sector-wide figures into context - and underscoring the pressures facing pizza brands in particular - Vanifatova adds:

Although the total hospitality market has seen new store growth, that’s happening in the face of falling footfall and tightening margins. The pizza segment tells this story vividly – aggressive discounts, rising delivery costs, and minimal price flexibility are all compressing profits.

Higher inflation rates returned last month due to government tax changes, which have further challenged both operators and consumers. But even so, consumer-facing prices across some of the fast-food sectors are not keeping pace – especially in high-pressure categories like pizza.

Despite these challenges, the growth we’re seeing in store numbers suggests brands are still betting on expansion. But with competition heating up on all fronts – pricing, promotions, and platform control – my advice, particularly for pizza brands, is to adopt a data-driven, omni-channel strategy. Monitoring real-time competitor intelligence, optimising pricing and deal structure, and aligning experiences across owned and third-party channels will be key to surviving, and thriving, in this increasingly complex environment.

While you can expect further roundups from Meaningful Vision throughout the year, highlighting notable hospitality trends, please shout if you’re in need of specific data to support a story and Meaningful Vision would be happy to help.

About Meaningful Vision:

Meaningful Vision is a leading provider of market intelligence data for the hospitality industry, offering insights into pricing, promotions, locations, and traffic data for the UK, Ireland, France and Germany markets. The company solution is a unique combination of big datasets, modern technologies such as machine learning and AI and industry expertise and data analysis competences.

Analysing the behaviour of 10M consumers in the UK and more than 500K price points items during a year, the Meaningful Vision solution empowers companies to assess their market performance relative to competitors and identify avenues for growth.