If you would like the business rates team at S&W to provide a complimentary 2026 health check, with a forecasted 2026/27 bill calculation and a check for RHL multiplier eligibility or just to seek advice on your current situation, please contact [email protected]

The dust has now settled on the Autumn Budget and release of the Valuation Office Agency’s (VOA) draft 2026 rating list.

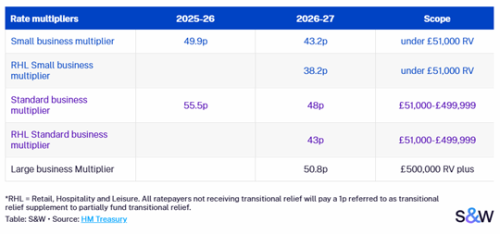

From 1 April 2026, the business rates landscape will change significantly for the hospitality sector. The post-pandemic Retail, Hospitality and Leisure (RHL) relief scheme will end and be replaced with a permanent system of five multipliers. These changes coincide with the introduction of VOA’s 2026 revaluation.

The changes

From 1 April 2026, two lower multipliers will apply for hospitality:

- The small business RHL multiplier will be set at 38.2p

- The standard RHL multiplier will be set at 43p

This will be funded by a 50.8p high-value multiplier for properties with a Rateable Value (RV) over £500,000, meaning operators with larger premises will pay more than the standard multiplier.

2026 business rates revaluation

The VOA have now released their draft list figures for the 2026 revaluation.

2023 RVs were based on rental data from 1 April 2021, particularly within the RHL space these were depressed by the impact of the pandemic. New 2026 RVs are based on rental data from 1 April 2024, where rents have largely seen a post-pandemic recovery. Any benefits of a lower multiplier could be negated by large increases in rateable value.

A transitional relief scheme will be implemented in 2026/27. This caps the amount a bill can rise, based on RV thresholds.

| Rateable Value | Bill Increase Cap 2026/27 |

| Small (RV up to £20k/£28k London) | 5% |

| Medium (RV from £20k/£28k London to £100k) | 15% |

| Large (RV over £100k) | 30% |

A new 1p supplement to multipliers will be implemented for ratepayers who do not receive transitional relief or help under the supporting small business scheme to partially fund transitional relief for the 2026/27 rate year.

Preparing for April 2026

It’s imperative that hospitality businesses are taking the opportunity to review both their 2023 assessments and new 2026 RVs to ensure that these are accurate. The clock is now ticking on the opportunity to appeal 2023 assessments, with the deadline to submit any checks of 31 March 2026.

We would recommend an audit of previous rates bills, to ensure all reliefs have been applied and earlier liabilities are correct. Whilst billing authorities should have applied relevant reliefs, this is not always the case, as we have found for a number of clients.

If you believe your 2023 valuation is too high, and have not formally appealed the valuation, now is the time to act. Depending on the type of business and property, these assessments will be based on either rental data from April 2021 or an assessment of the annual level of trade.

While 2026 rateable values cannot be formally challenged until 1 April 2026, the factual details of the property can be checked now. Correcting any discrepancies in the data the VOA currently holds for the property, could result in a refund for any overpayments made in the 2023 rating list and ensure the correct factual data is used to calculate the 2026 RV.

Given the complexity involved with the business rates appeal process, we would always recommend engaging a reputable rating agent to review the specific circumstances and would be able to advise on the best course of action.

If occupiers are undertaking or considering any major redevelopment works to their properties, this could provide an opportunity to either reduce the rateable value, or have the property removed from the rating list entirely for the duration of the works.

Likewise, where businesses are investing in improving their properties, under the improvement relief scheme, any RV increase attributable to the qualifying works would be exempt from business rates for 12 months from the date of completion.

Other important reliefs to for business to consider are Small Business Rates Relief, if your RV is below the £15,000 threshold and any empty or part-empty relief you may be able to apply for.